ECO, "STRICT FINANCIAL GUARANTOR" AND REDENOMINATION RISK

Disponible

ECO :

Exposure to the redenomination risk compromises France's position as the "strict financial guarantor" of the ECO.

Sams Dine SY 06/06/2020

Available

The adoption, on May 22, 2020, by the French National Assembly of Bill No. 2986 to change the Fcfa to Eco is one of the many repetitions of history since the 1960s, most often in the form of tragedy but this time in the form of a farce. To persist in positioning oneself as the "strict financial guarantor of the eco" just when the Financial Stability Review (26 May 2020) warns of the exposure of 3 member countries, including France, to the maximum of redenomination risk, is totally inconsistent. It would be difficult to show more short-sightedness and inertia to persist in preserving the status quo in the name of a cosmological vision that served as the conceptual basis for "Africa brings its eco". The reflection of the Centre d'Etudes Prospectives et d'Informations Internationales (CEPII) published in 2005 leads to this positioning, after this subject was placed at the heart of official economic analysis and research circles. However, this study is riddled with errors that affect the relevance, coherence and effectiveness of this positioning and jeopardize the interests of France and African countries in the CFA zone as well as those of the Euro zone and Africa at the beginning of the 21st century.

This bill is surprisingly of poor quality due to a lack of contextualization. It uses an authoritative argument to perpetuate the subordination of African Franc Zone Countries (AFZC) and ignores Africa's experience in regional integration. There is only haste and nervousness in its preparation. Precipitation, because the economists maneuvering had the ECB's conclusions in mind, given their proximity to the authors of the review it has just carried out.

Nervousness, when the dreaded accident occurs in real time. This is undoubtedly the reason for the call to the community of economists and other members of the Vox network to set up a commission of experts on major economic challenges. The reaction of its President confirms the scale of the urgency when he states that "the great danger would be to forget the future of France and Europe in the response to the crisis". It merely confirms the warning issued in 1931 by Paul Valéry and taken up by Pierre Schaeffer in 1970 as if these two players were still going backwards into the future. To put it another way, taking inspiration from this speech on Africa held in November 2017, "the problem of France and Europe is that the French and Europeans have not yet entered the future enough! ».

This bill is surprisingly of poor quality due to a lack of contextualization. It uses an authoritative argument to perpetuate the subordination of African Franc Zone Countries (AFZC) and ignores Africa's experience in regional integration. There is only haste and nervousness in its preparation. Precipitation, because the economists maneuvering had the ECB's conclusions in mind, given their proximity to the authors of the review it has just carried out.

Nervousness, when the dreaded accident occurs in real time. This is undoubtedly the reason for the call to the community of economists and other members of the Vox network to set up a commission of experts on major economic challenges. The reaction of its President confirms the scale of the urgency when he states that "the great danger would be to forget the future of France and Europe in the response to the crisis". It merely confirms the warning issued in 1931 by Paul Valéry and taken up by Pierre Schaeffer in 1970 as if these two players were still going backwards into the future. To put it another way, taking inspiration from this speech on Africa held in November 2017, "the problem of France and Europe is that the French and Europeans have not yet entered the future enough! ».

AN ECONOMIC COSMOLOGY

An economic cosmology of inertia and short-sightedness

The formulation of the bill is based on an authoritative argument motivated by the idea that West Africa does not meet the criteria for an Optimal Monetary Zone (OMZ), that a fixed exchange rate is necessary for the CFA zone and that the independence of the monetary policy of central banks is compatible with the free movement of capital. Hence the need for a financial guarantor and a fixed anchor for the Eco. Even laymen in international finance economics know that the MTA is just another name for the dollar zone. To take refuge behind this argument is to sanctify this zone and to erect a barrier to the appearance of any other monetary union, including in Europe.

The US currency determines the entire global financial cycle through the value of the VIX, as evidenced by the historic peak it reached in 2006, heralding the Great Recession, and that of 2020 has just been surpassed. This index is at the heart of the volatility targeting strategies of hedge funds with a majority of American and European investors, which condemn developing or emerging countries to permanent financial fragility through capital flight and debt savings.

The desire to preserve the status quo in Africa is therefore the best indicator of France's downgrading at the beginning of the 21st century to the point of being assimilated only to these "lone warriors", to use the terminology of the "EU's Global Strategy for Foreign and Security Policy" presented in July 2016 to the leaders of the European Union. Yet the warning was very clear and the target obvious.

The Council of State and/or the French Constitutional Council would do itself credit by rejecting the bill. All those who are committed to the rule of law must express their indignation at this unbridled expression of the negativity bias. They would thus go down in history by putting an end to the entrenched colonial obsession and permanent violence against Africa.

In any event, the confirmation of this position by anybody whatsoever, in Africa or elsewhere, constitutes a violation of amended article 64 of the WAEMU Treaty.

.

FRANCE'S POSITION

At the root of France's position is a deliberate desire to ignore the changes at work in Africa.

Moreover, what is the relevance of this positioning when the economic system that serves as a reference is no longer WAMU, even well before the signing of the WAEMU Treaty, which in its preamble is in line with ECOWAS objectives? The attributes of the Eco, especially in the context of the Euro's dropout, make this positioning obsolete. Not taking them into account is tantamount to denying the existence of this REC and reducing member countries to mere overseas territories. In addition to this first error of analysis, there is a second one which stems from the inconsistency of maintaining the "fixed euro cfa parity" with the economic objectives of the member countries. These two errors stem from a deliberate desire to ignore the African regional agenda in which economic and monetary integration has been taking place since the early 1990s. A short detour will refresh memories of the actions taken to dispossess Africans of any initiative in the area of knowledge construction.

The CEPII paper is based on the hypothesis that the lessons of the European experience in monetary union inspired the non-WAEMU ECOWAS countries to organize themselves around the West African Monetary Zone (WAMZ) as early as 2002. This statement is simply false, since the whole of Africa had anticipated these changes as early as 1990 with the United Nations Commission for Africa (E/ECA/TRADE/91/33; 1991), i.e. well before the creation of the European Economic and Monetary Union. At the time, it was a matter of organizing to free the continent from the obstacle to integration efforts represented by the CFA Franc Zone. The African and European regional economic and monetary institutions concerned had, as it should be, been invited to join the reflection. They agreed to become involved except the African regional central banks. However, the Governor of one of them, "open to an ambitious reform of the CFA Franc Zone" had clearly expressed his intention to contribute to it, if only to overcome the austerity imposed by the structural adjustment programs. This audacity earned him to be dismissed, depriving this institution of a governor for 3 months, no doubt to avoid the loosening of tongues. The French monetary institutions appropriated in the work of the ECA what was compatible with the interests of France and had the creation of the WAEMU endorsed by the organs of the CFA Franc Zone in April 1991. This was to make people forget that economic integration was also at the heart of the reforms of the Franc Zone between 1972 and 1975 carried out at their initiative.

With the current draft law, history is repeating itself over and over again to make people forget that the French guarantee of 1991 should not go beyond the "moral guarantee" to a CFA zone which, moreover, could do without it, as was so well documented in November 1988 by the publication of the African Centre for Monetary Studies (volume 1 n° 11). Despite the modesty of its positioning as a "strict Financial guarantor", the bill is in line with all the previous reforms. The response was in fact organized as early as 2002 with the creation of the WAMZ by ECOWAS countries outside WAEMU.

Ironically, the words of the former governor of the BCEAO on "the ambitious reform of the CFA Franc" are repeated by French leaders to push their agenda based on his experience. This fate hangs over all the leaders of countries that have at one time or another belonged to the Franc Zone since the Second World War with the same obsession: to block any desire for autonomy and regional integration. Whether they denounce cooperation agreements, openly oppose them, propose a grooming, envisage a deepening and even a simple institutional audit and the sanction falls, always implacable and radically destructive

A WINDOW OF OPPORTUNITY

A Window of Opportunity for Deepening African Economic, Monetary and Political Integration

A careful reading of the bill reveals a new hierarchy of norms that is unacceptable to WAMU. It effectively excludes any rapprochement with Nigeria and Ghana. It raises a new barrier to deepening through economic and political integration. It is difficult to do better to fragment the continent when the target is less WAEMU and ECOWAS than the African Continental Free Trade Area (AfCFTA). The African Union has an obligation to call on the stakeholders - including the European Union - to put this imbroglio back in order. It should take the opportunity to reconcile them by imposing greater transparency in the analysis of both the continental challenge and the regional agenda.

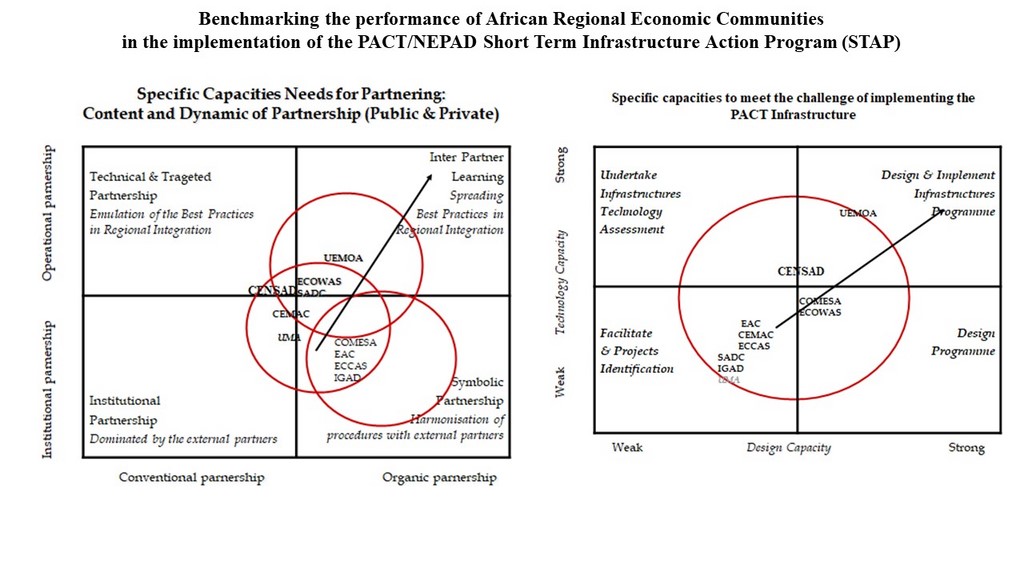

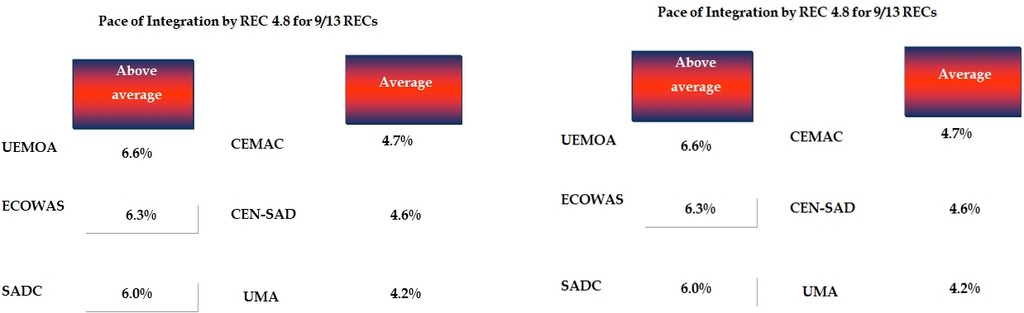

In so doing, it could put an end to the fixed structure of the Regional Economic Communities (RECs) with a view to reducing their number in the perspective of deepening the AfCFTA. The decision to limit their number to 8 was taken in haste at the Banjul Summit in 2006 in reaction to the benchmarking exercise in the context of the implementation of NEPAD initiatives. Because that exercise propelled WAEMU to the top spot confirming the ranking achieved by the United Nations Commission for Africa, it was necessary to block at all costs any prospect of deepening regional integration from that organization. This decision had only disastrous consequences, as it resulted in a lost decade for regional integration. The major powers have exploited this linguistic dispute to hijack the Initiative for the Development of the RECs after celebrating it at the 2007 G8 Summit in Heiligendamm, Germany. Having, to everyone's surprise, decided to entrust the steering of regional integration to the World Bank, they ended up abandoning everything in 2010, under the pretext of misunderstandings, difficulties and leadership problems. The European Union (EU) took the opportunity to freeze its support to the RECs for non-signature of the Economic Partnership Agreements, thus putting an end to all forms of support. However, this did not prevent EU member countries from attacking the most successful regional organizations to delimit their territory.

In so doing, it could put an end to the fixed structure of the Regional Economic Communities (RECs) with a view to reducing their number in the perspective of deepening the AfCFTA. The decision to limit their number to 8 was taken in haste at the Banjul Summit in 2006 in reaction to the benchmarking exercise in the context of the implementation of NEPAD initiatives. Because that exercise propelled WAEMU to the top spot confirming the ranking achieved by the United Nations Commission for Africa, it was necessary to block at all costs any prospect of deepening regional integration from that organization. This decision had only disastrous consequences, as it resulted in a lost decade for regional integration. The major powers have exploited this linguistic dispute to hijack the Initiative for the Development of the RECs after celebrating it at the 2007 G8 Summit in Heiligendamm, Germany. Having, to everyone's surprise, decided to entrust the steering of regional integration to the World Bank, they ended up abandoning everything in 2010, under the pretext of misunderstandings, difficulties and leadership problems. The European Union (EU) took the opportunity to freeze its support to the RECs for non-signature of the Economic Partnership Agreements, thus putting an end to all forms of support. However, this did not prevent EU member countries from attacking the most successful regional organizations to delimit their territory.

THE « "REDENOMINATION RISK" »

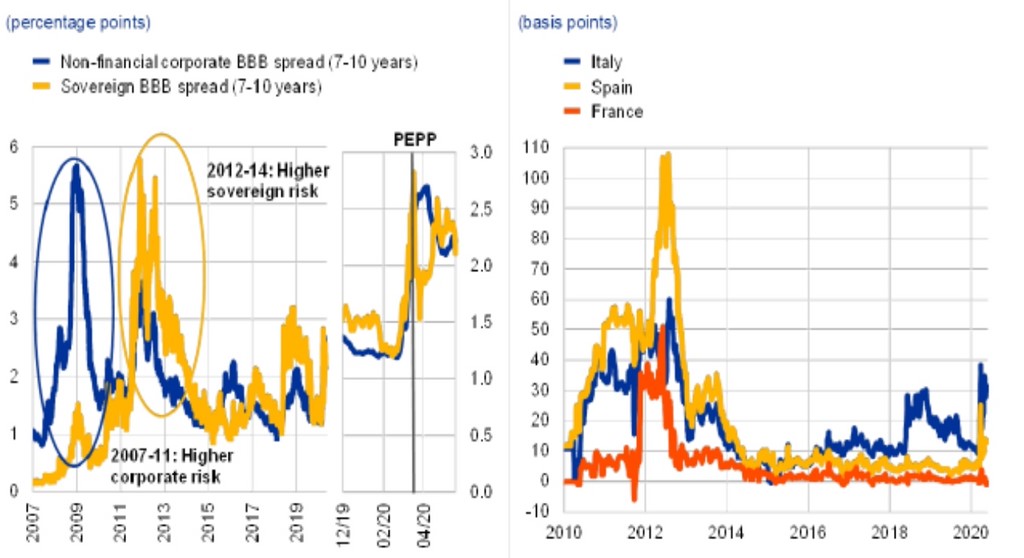

How can one be eligible for financial guarantor status with such a high "redenomination risk" by 2023?

However, the much-feared accident has just occurred with the sudden decision to change the fate of a stone lost in the depths of the Pacific Ocean in the China Sea, following the revocation of its preferential trade status by the USA.

What is the link with the Euro and the Eco? It is anything but a "butterfly effect" because Hong Kong is the world's 3rd largest financial center and 8th largest trading center, making it the archetype of the intensive and extensive platform that, along with Singapore, is the major place for high-frequency trading in Asia. Hong Kong merges with the "first bank in Europe", which is also considered the apostle of free trade and the driving force to create a world favorable to the Global Britain project. The revocation of commercial status completes the island's reintegration while making this bank China's first international bank. With these new platforms, financial globalization is at a historic turning point.

The domino effect on the Eurozone begins with the European Union leaders' great deviation to preserve the Chinese goat and the American cabbage. No wonder then that the United Kingdom is jumping into the breach by reaffirming it will embody the Global Platform of the 21st century and not just Singapore-on-Thames. Always with the idea of taking the "pound of flesh", an expression taken from W. Shakespeare's play that inspired M Thatcher (I want my money back), then the Brexit. The effect is to divest or close its European retail and investment banking network to better focus on purely commercial activities and volatility targeting strategies, especially when the VIX index reaches or even exceeds its 2006 level.

No other bank in the Eurozone is a candidate for the takeover since the announcement of the sale of these assets, even at the symbolic price of one euro. Unless there is massive support, the story of Lehmann Brothers will repeat itself this time from Europe. Meanwhile, the member countries are fighting over the last zero 0 of the amount of the financial package of the recovery plan, the "Club Med" countries wanting to add one to match the USA, the "Frugal Countries" persisting in withdrawing one so as not to give a bonus to laxity. The rest is easy to guess, less in the form of a scenario than a chain of causes and effects: a boost from the US and the fracture within the Eurozone between the poorly endowed countries (Club Med) and the countries exposed to British appetites becomes gaping, the latter resolving to join its free trade area.

The milestones set for Nigeria (the Naira is quoted on the London Stock Exchange), the downgrading of the ratings of other regional powers such as South Africa, and the procrastination on the cancellation of African debt make these countries receptive to any proposal for a paradigm shift as long as it holds out the prospect of a massive influx of capital on the condition of privatizing the management of public infrastructure in order to supposedly improve access and availability and thus reduce poverty and inequality. Disillusionment could then be cruel: whoever liked the advent of the debt economy that literally dried up the continent in the 1970s will love the breastfeeding society once all Africa's resources are privatized in less time than it would have taken to negotiate a debt moratorium to deal with the Covid-19 pandemic.

The history of Africa is a never-ending repetition, sometimes as a farce and sometimes as a tragedy. All these episodes and many other twists and turns underline the importance of not giving in to the sorcerer's apprentices who are the bearers of excessive financialization and to the predators who are constantly stirring up linguistic or leadership conflicts to slow down continental economic, monetary and political integration. The context of the Covid-19 pandemic and the current global financial crisis lends itself to this.

Sams Dine SY 06/06.2020

Former facilitator specializing in expert group management

Animator of the platform:

Global Foresight, Policy Analysis and Africa Capacitary Transformation which brings together its papers, surveys, studies, books and methodologies in open access

Animator of the platform:

Global Foresight, Policy Analysis and Africa Capacitary Transformation which brings together its papers, surveys, studies, books and methodologies in open access

------------

infography