ANALYSE DE POLITIQUE

Déploiement en Afrique

New Modes of Governance in Africa

PAMNET PROJECT ON NEW MODES OF GOVERNANCE

From Market Principles to Innovative Approaches

Draft 00

Draft 00

Concept note by Sams Dine SY

CONTEXT

In search of good governance, African countries leave from the traditional bureaucratic approach of public administration and management and move towards new modes of governance by introducing innovations and market-based approaches.

This quest concerns a growing number of administrations despite the requirement of high skilled staff and sophisticated analytical tools. This new landscape is challenging the African countries which adapt with slowness while the increasing number of support programs to close capacity, knowledge and competencies gap and to draw the countries out of the poverty trap.

The situation is however not so new only that. During the 80-90ties, African countries were confronted with a wave of a market-based governance through the Washington Consensus framework - among others – privatisation, divesture, competitive restructuring and public sector audit practices. However, the results were modest according to the overall countries performance, poverty and discrepancy between real and potential output growth, corruption and brain drain.

Since the beginning of the Millennium, Africa is flooded by another wave of modes of governance, in order to fight poverty and scale up aid. Among others are MDGs-based governance, Nepad Initiative on governance, and also governance assessment tools. Several areas and level are flooded like public governance, economic and monetary governance, finance and corporate governance, at multi, national and local levels.

This project focused on some conceptual, methodological, and practical issues and concerns on good governance in African countries. It covers areas where innovations and adoption of new modes become heavier through processes of dissemination, emulation, imposition and harmonisation of best practices in good governance:

- New modes of market based governance: PPP, Outsourcing, Competitive sourcing…

- Good central bank governance through independence, accountability and transparency

- Assessing MDGs-based governance: Survey on best practices

OBJECTIVES

Project aim

Project aim

The Project aim is to build infrastructure for a knowledge network in the area of good governance, focused primarily on best practices, new modes, innovative approaches, and evaluation methods.

Case studies will be conducted in areas where good governance capacity is vital for stabilisation of output and growth, allocation of resources and redistribution to poor such as African Central Banks, Regional Corporation, and PPP Authorities.

The network will include TAPNETs members, professionals, scholars and political leaders.

Moreover the Project has a clear check-and-balance strategy of the executive, legislative, judicial and monetary power in African countries, since there is no good governance without external stakeholders and independent body of policy analysts.

The project will encourage cross-fertilization, joint policy analysis, multi-disciplinary approach, cumulative exchange of experiences and tools for performance measurement, survey and case studies that lead to practical, methodological and empirical advances in the field and publications.

Objectives

to built knowledge base for good governance in specific areas - African Central Banks, Regional Corporate, and Quasi-Autonomous Government Organisations - and promote best practices among them and external partners;

to assess impact on institutional structure at national, regional and continental levels, capacity gap and implications for TAPNETs.

THEMES

1. Good governance in Africa and innovative market-based approaches: case study of Public Private Partnership, Outsourcing, Competitive sourcing…

As a supplier of goods and public services, the State is increasingly constrained to carry out exceptional performances in the presence of governance failures for example in devolution of competence, services delegation, and contracts management. That results in a progressive change of its institutional profile. From contactor and services supplier, it evolves towards strategist and manager of providers with reference to best practices in the private sector. What is the situation in Africa? How the administrations face these challenges and what is the cost and benefits? What are the chances of success taking into account past experiences on privatization and restructuring?

The theme will focus on PPP, Outsourcing, Competitive Sourcing, among other in order to gather available information on these approaches and tools, on-going experiences, achievements at national and regional level and the lessons.

Team

Leader: S.D. SY

Members:

ACTIVITIES

- To Map Capacities, Knowledge and Competence on Good Governance, innovations, and new modes. The project will review African expertise related to governance and design a conceptual framework for good governance in selected areas

- To Organize Workshops and seminars for network members relating to issues on good governance

- To undertake survey on three areas by three PAMNET members- Independence of central bank in Africa in an historical perspective: retrospective, prospective and lessons for the future African Central Bank

- Central bank accountability in an institutional perspective: views of stakeholders (Government, Private sector, Civil society)

- Central bank transparency: comparative perspective and views of international/regional financial institutions (IMF, WB, BIS).

- Central bank transparency: comparative perspective and views of international/regional financial institutions (IMF, WB, BIS).

EXPECTED OUTPUTS

1. Capacity, knowledge, and competency gaps in Good Governance, are identified in selected countries

2. An operational forum for dialogue, information exchange and sharing of lessons for public policy and support strategy

3. Technical skills of the network members, external partners, such as application of checks-and-balance strategy knowledge-based performance assessment, and output based management, in a good governance context

4. Capacity of network members to assess impact of new modes of governance and undertake independent prospective evaluation is improved

5. African Initiatives and Programs at regional and continental levels are knowledge-based on more relevant good governance approaches.

2. New modes of governance and African central banks: case study for independence, accountability and transparency and lessons for the future African Central Bank

Central bank play a growing role in African economy and their position with regard to government is a focal point of controversial through academicians and practitioners, The monetary power challenges other three constitutional powers (executive, legislative and judicial) since stabilization is the principal objectives of macroeconomic policy in Africa.

Adding to this is the discussion about good governance as a means to provide macroeconomic stability, economic growth and a level playing field for competition and partnership. The needs to carefully manage the expected surge in aid flow during the next ten years, prevent financial contagion, and ensure adequate macroeconomic management are also some of the challenges generating interest in central bank governance at national and regional level.

Given their core functions, central banks are the focal point to achieve these goals when they are good governance-based. Central bank governance is good when objectives and tasks delegated are performed to avoid wasting of resources.

If the problems of the good governance within the traditional public and economic administrations were subject of growing attention during years, it is not the case for central banks. In Africa, they function with opacity. They benefit from an exceptional legislation for financing management costs and for control, insofar as they take their resources on the incomes drawn from monetary creation before assigning the benefit to the State through Department of Treasury. This situation is worth as well for the national central banks as for the regional central banks. Thanks to this procedure, they set up consequent incentives for their high skilled staff, without always to be able to retain them insofar as the most skilled are hired by International Financial Institutions like IMF, WB and AfDB, without possibility to return in the originating departments.

The weakness of the capacities for control and evaluation in Accounting Offices bring to questions on how the core principles of good governance of central bank (independence, accountability, transparency) are adopted and implemented. Another question is how central banks escape bad governance plagues like brain drain, and corruption which are endemic in Africa.

Independent capacities to undertake central bank governance assessment and control are scarce and it is difficult to avoid conflict of interest and collusion in this area because expertise is frequently embedded with retreated central bank officers.

What lessons to draw from central banks to improve governance capacity in public sector? African countries are characterized by narrow markets and failures and conflicts and one can wonder whether the performance of the central banks is equal to the privileges they profit and how to build check and balance capacity in this area.

The theme will explore good central bank governance through three principles:

- Independence of central bank in Africa in an historical perspective: retrospective, prospective and lessons for the future African Central Bank

- Central bank accountability in an institutional perspective: views of stakeholders (Government, Private sector, Civil society)

- Central bank transparency: comparative perspective and views of international/regional financial institutions (IMF, WB, BIS).

Team

Leader: S.D. SY

Members:

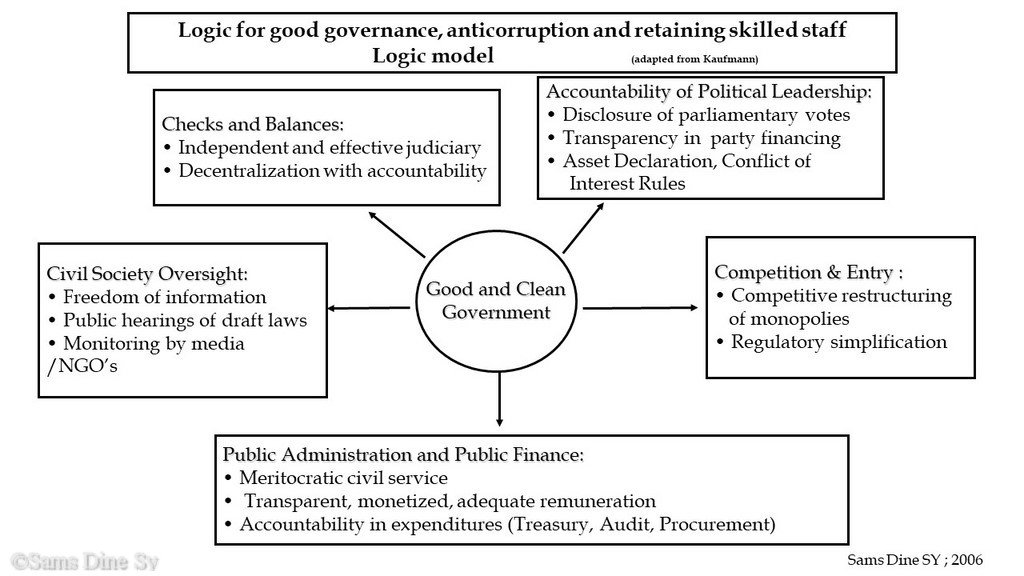

3. Assessing good governance: survey on best practices, lessons, and road map for African policy analysts

This theme deals with good governance problematic in Africa but focus on performance assessment and the relevance of the underlying conceptual and methodological framework. What good governance approaches are introduced in Africa? To what extent they refer to the best practices? What type of conceptual and methodological problems they face? Are the performance indicators relevant for good governance?

The poor performance of the continent calls for a new questioning on:

- the nature of the public, economic and corporate governance: who governs and how?

- Innovations, new modes of governance and their introduction: what strategy (imposition, harmonisation, emulation, or dissemination)?

- evaluation methods of good governance policies and practices: what tools and for what results?

- Relevance of governance capacity approaches for political leadership, public expenditures, civil society, checks and balances and competition for entry.

Good governance approaches and tools in selected areas will be reviewed:

· MDGs-based governance

· Nepad Initiatives on governance (public, economic and corporate)

· Market and Network-based governance

· Governance assessment approaches and tools.

Team

Leader: S.D. SY

Members:

BUDGET

tbd